MONDAY, FEBRUARY 12, 2018

Over the last 12 months, the United States has had numerous outbreaks of fires. These fires happen in any type of dry climate. Many of them create significant damage. They destroy entire communities.

Many homeowners do not realize there are steps they can take to minimize these risks. You cannot stop forest fires from occurring on a grand scale. And, you will always need home insurance to help you cover the losses from these types of events. However, there are steps you can take to protect your home.

Create a Defensible Space Around Your Home

At the heart of reducing the risk of wildfires is your ability to create a space around your home that slows down the wildfire’s access to it. It may even allow the fire to go all the way around the home, leaving it untouched. To do that, consider these steps.

- Use native vegetation in the area that is less likely to catch on fire.

- Be sure an irrigation system is in place and working well.

- Be sure all vegetation surrounding your home is healthy. Remove dead or dying limbs. Prune all trees and shrubs.

- Space out larger trees to limit their ability to touch and spread a fire. Aim for at least 10 feet between them.

- Be sure all flammable liquids around your home are safely stored. Use metal cans for them.

- Do not use wooden fencing that connects to your home and to the neighbor’s home.

Utilize Nonflammable Materials

The fact is, many wildfires will spread close to the home. To avoid the most extensive damage, utilize non-flammable materials or build your home with fire-resistant materials wherever possible. Many residents of fire-prone areas have convenient access to these materials.

- Non-combustible roofing materials are essential.

- Install spark arresters within the chimney.

- Use fire-resistant materials such as treated wood to box in all of the home’s eaves, soffits, subfloors, and fascia.

- Cover exterior walls with materials that will not catch on fire. This includes stucco, brick, or even stone.

- Place non-combustible screening over the top of all eaves and vent openings.

It is also a good time to speak to your home insurance agent. Be sure that your insurance coverage is ample. Discuss any type of risks the agent sees on your property. He or she can offer advice on minimizing these types of risks. Be aggressive in defending your home. You may be able to watch the fire spread around it instead.

FRIDAY, FEBRUARY 2, 2018

You have home insurance for a reason. You know that it is there to help you if you need to file a claim. But, will filing that claim cause your insurance rates to rise? This is a common concern. home insurance for a reason. You know that it is there to help you if you need to file a claim. But, will filing that claim cause your insurance rates to rise? This is a common concern.

In some cases, the answer is yes. In others, there is no need to worry. In short, if an event happens that requires filing a claim, do so. Don't let your own solvency suffer because you decide not to use your insurance.

Should You File a Claim?

It is not always so easy to know whether or not you should file a claim. In some cases, filing a claim would not make sense. If you have to pay your full deductible first, that may mean the insurer will not provide much financial support. And, filing claims frequently can, in fact, make it harder for you to get insurance down the road.

Usually, you should take it upon yourself to fully cover small home damages. Only in the case of major damage should you use your insurance. The best option here is to make a decision with the help of your home insurance agent.

Which Types of Claims Increase Premiums?

There are some types of home insurance claims that might cause an increase in your premiums. This happens because these tend to be instances where a repeat claim is more likely. This makes your home more of a high risk to the insurance agency. Common claims that do this include:

- Water damage claims. This includes damage from frozen pipes or faulty plumbing that you have coverage for. NOTE: Multiple water claims usually lends to non renewal.

- Slip and fall claims. Someone slips on ice, stumbles over a sidewalk crack, or falls from your home’s room, are common claims.

- Dog bites. This is perhaps one of the most common claims for liability coverage, and the average lawsuit is settle for $26,000. It is likely to raise your rates. Repeated claims may lead to limited access to coverage, too. You may need special insurance if this happens more than one time.

When Should You File a Home Insurance Claim?

When an incident occurs, call your home insurance agent. Discuss the specific instance with your agent. He or she can help you to decide whether to file the claim. This type of open connection is important. Some agents are not likely to encourage you to file a claim unless it is necessary and offers you important financial protection.

Home insurance claims happen all of the time. Not all will result in an increase to your premiums. However, it is never advisable to keep information from your agent about the instances that occur in and around your home. With the right assistance and research, you can file a claim whenever necessary.

FRIDAY, JUNE 16, 2017

Homeowners, Condominium, and Renters insurance policies have Contents coverage built in to each policy. The best way I can communicate contents coverage is if you turned your house upside down what fell would be deemed contents. Something very important that many clients don’t know about their content coverage is the limited coverage items that are truly valuable to them.

Jewelry Coverage

Finding out that you have had your cherished heirlooms stolen can be devastating news, and buying new pieces won’t truly replace what you have lost, but if you do have valuable jewelry it is advisable that you take a look what you have and then sit down with your insurance agent. For jewelry theft, expect a maximum homeowners payout of $1,000 (total aggregate not per item), and half that amount under a renters policy.

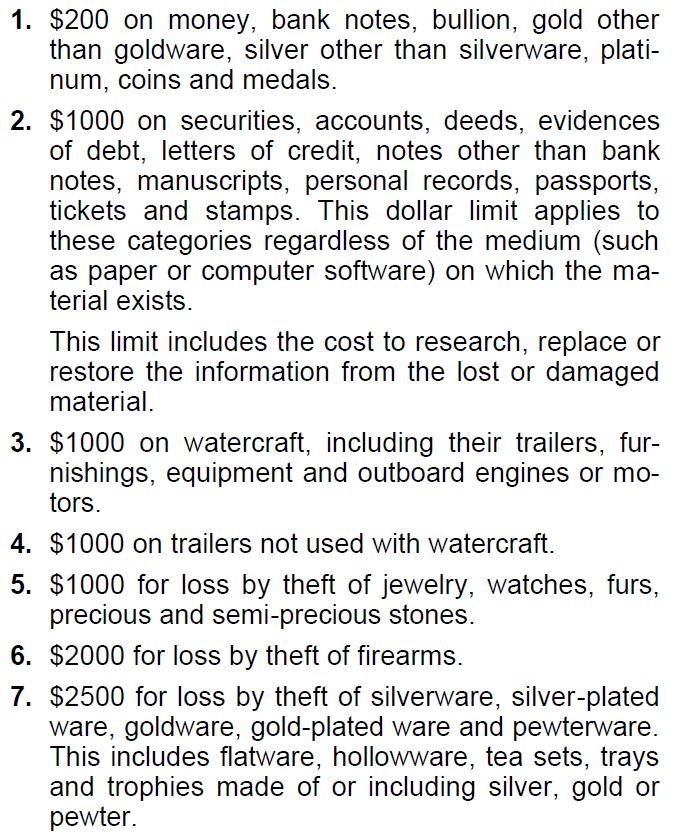

Here is a more complete list of coverage

Most of the coverages listed above can be endorsed to an appropriate level for you and your family on a new or existing policy.

Here is a Link to more information on Homeowners coverage or to request a homeowners quote.

|

Blog Archive

|